We are licensed in the following jurisdictions

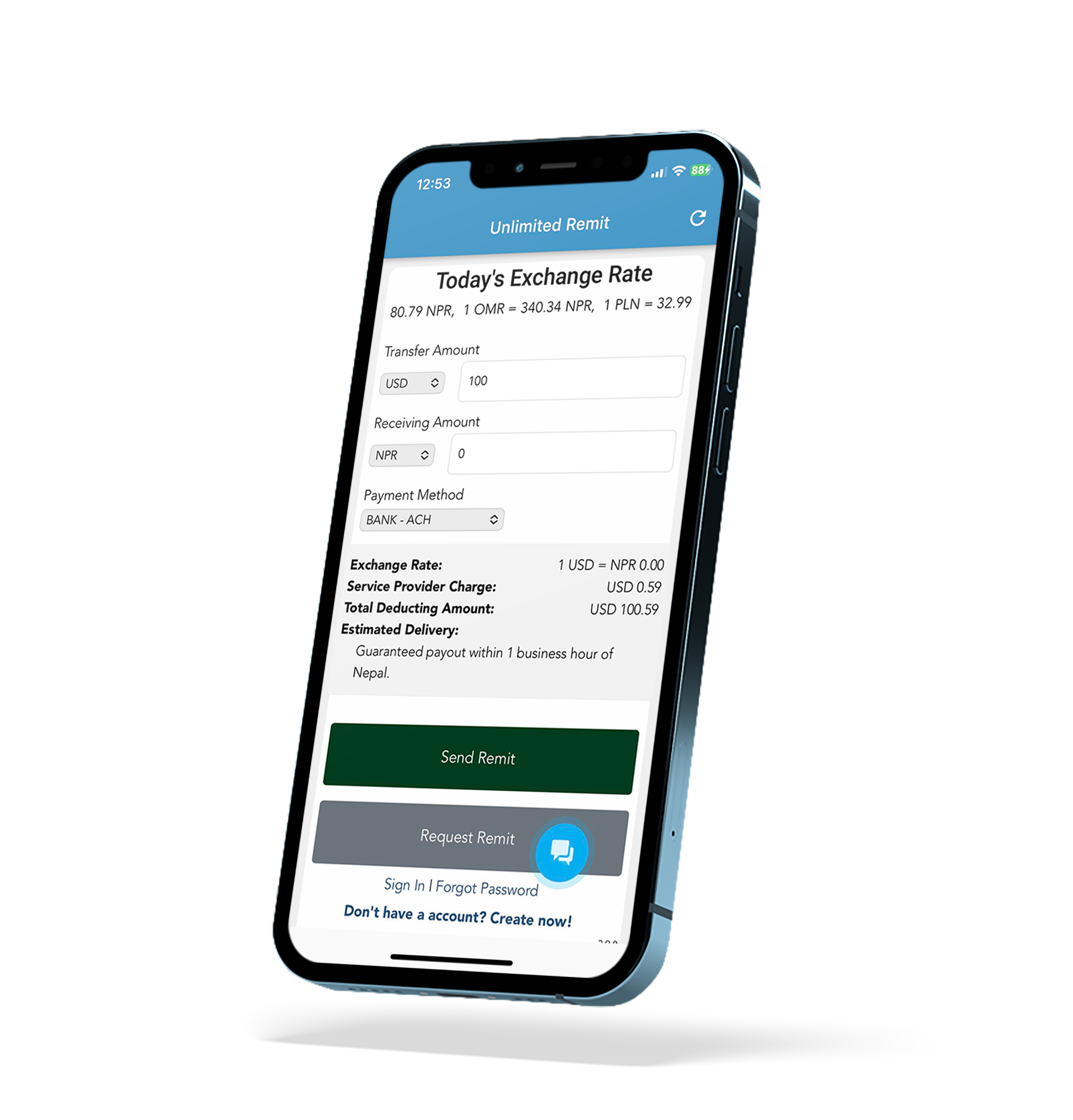

Nepal: Unlimited Technology Pvt Ltd Unlimited Building, Khichapokhari, PO Box 956, Kathmandu, NEPAL holds a license for Remittances from Nepal Rastra Bank

USA: Unlimited Cloud LLC, 10685-B Hazelhurst Dr 18549, Houston, TX 77043, USA holds MSB Registration No. 31000204408346 from Financial Crimes Enforcement Network, of Department of Treasury of the US Government as Money Services Business.

Money transmission services relating to the Passport Program are provided by Priority, directly or through its subsidiary Finxera, Inc. (NMLS #1168701) or its authorized affiliates and contractors.

UK: Unlimited Remit Ltd, 85 Great Portland street, First Floor, London, W1W 7LT.

Poland and EU:OUR ZAP SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄul. HOŻA, nr 86, lok. 210, miejsc. WARSZAWA, kod 00-682, poczta WARSZAWA, kraj POLSKA

CANADA: Asimit Remittance Ltd 1224-13351 Commerce Pkwy, Richmond, BC V6V 2X7, Canada holds license No. M23578321 from The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as Money Services Business and Payments Services Provider license by Bank of Canada

United Arab Emirates: Asimit Portal Est. Office 202, Saaha offices C, Souk Al Bahar Bridge, Dubai Mall, Downtown Dubai, UAE holds license No. 1376281 from Dubai Economy & Tourism as an online portal for remittances.