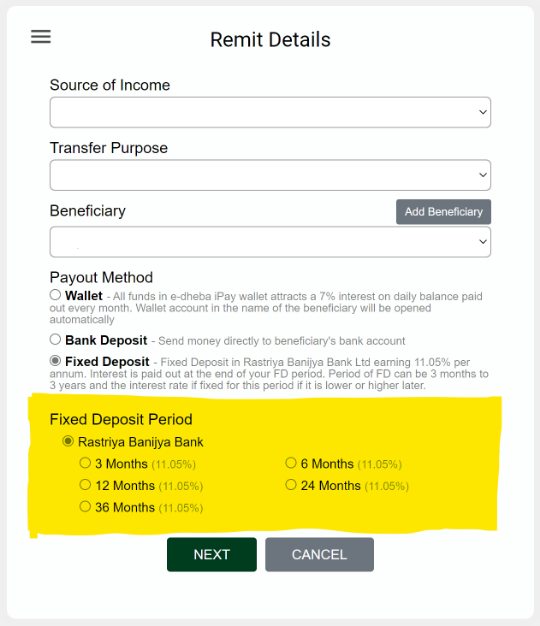

Highest Interest Rate

Earn the highest interest rates that any commercial bank is giving at the moment when you send a remittance and the FD is automatically opened under the beneficiary name. This is approved by Nepal Rastra Bank to provide an additional 1% interest on the highest interest rate.

Interest Rate For 3 month : 5.31% per annum

Interest Rate For 6 month to below 1 years : 5.81% per annum

Interest Rate For 1 years to below 2 years : 6.31% per annum

Paid: Quarterly